Finch & Beak is now SLR Consulting, a global organization that supports its clients on setting sustainability strategies and seeing them through to implementation.

We invite you to check out the SLR website, so you can see the full potential of what we offer, from sustainability strategies to implementation covering Climate Resilience & Net Zero, Natural Capital & Biodiversity, Social & Community Impact, Responsible Sourcing and more.

Amidst the maze of the offerings of various ESG benchmarks, that has even caught the attention of EU regulators taking note and introducing legislation that would aim to implement certain requirements for ESG benchmarks. However, this legislation has yet to be finalized, so companies will have to work to make sense of how best to avoid investing all time in reporting efforts, sacrificing the ability to make real impact through internal actions in what is known as the ESG Reporting Trap.

The first approach the companies are advised to take is to aim to select the relevant benchmarks that will bring value to the company. For this, we advise to focus on the richness and reach of the benchmarks. To understand this, the new Rate the Raters 2023 can help orient a company to those benchmarks that are most highly valued by stakeholders and analysts. But, a more powerful approach and one that can improve stakeholder engagement is to reach out directedly to investors to see which benchmarks they value most.

Once it has been determined which of the benchmarks will be able to yield insights for the company itself based on, for example, detailed results and comparisons to peers combined with the input of investors and other interested stakeholders, a company is advised to streamline its learnings. This means focusing on the benchmarks that matter most to the company, which is exemplified by the approach that DSM takes in outlining its approach to how it focuses on key ESG benchmarks.

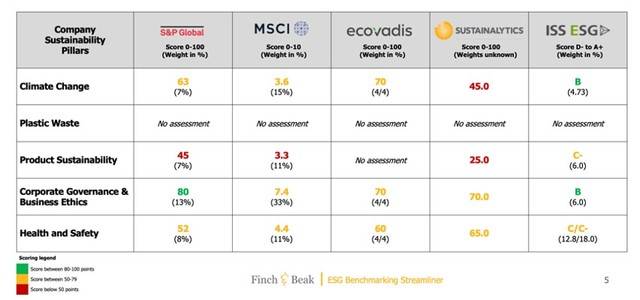

How can any company work towards having such clarity as DSM? We recommend utilizing the ESG Streamliner which helps to focus a company through both active and passive efforts. This includes an active approach in the selection of the most relevant ESG ratings for your organization. The first step of this is to evaluate how the company’s key sustainability pillars are represented across the various benchmarks (and useful to see how the company is performing). As seen below, strategic pillars are evaluated for their presence in various benchmarks as well as how the company scores. Sometimes, a strategic pillar may not even be present in the benchmark, highlighting a lower value for the company to continue to receive insights on how to further improve upon the performance of its key issues. As highlighted for the sample company below, plastic waste, a key sustainability issue, is not evaluated across any metric which does not yield strong insights, however, for EcoVadis, the topic of Product Sustainability is not highlighted reflecting a weak point for this benchmark.

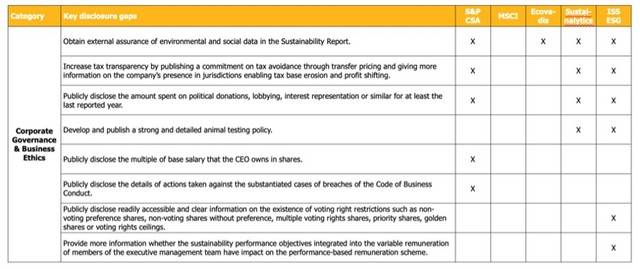

The next step of the ESG Streamliner is to supplement with other sources to evaluate the gaps that a company has across various benchmarks to understand where the company has public disclosure gaps. This will help to create an inventory of all the elements that a company still lacks in its public reporting as it relates to requirements across a broad spectrum of benchmarks. These are then consolidated into similar thematic assessment areas across the benchmark to create a condensed list of disclosures that would be able to satisfy various benchmarks if the data were to be published.

This can be particularly useful in aiming to identify where a company can make most gains across various benchmarks through increased disclosure in annual reporting for the key sustainability issues that align with its material issues. Or, for those issues that are not as material and are related to non-focus benchmarks, gaps can be closed through the creation of additional, thematic, factsheets. Sanofi, a pharmaceuticals company, leverages thematic factsheets that can be versatile tools to keep stakeholders well informed on key issues as well as satisfying several benchmarking requirements.

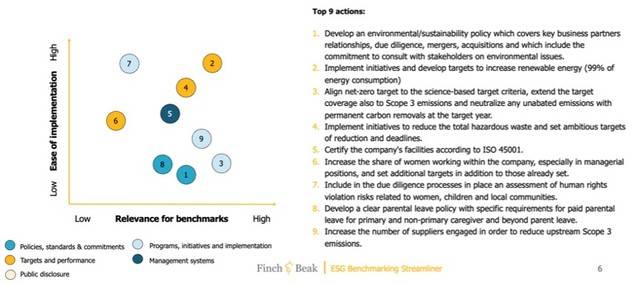

Once all gaps have been identified, it is then important to take a step back and establish an action plan of the key next steps for a company to begin to advance towards closing its gaps in disclosures. To do this, the largest gaps are mapped to the company’s business strategy, double materiality assessment and enterprise risk management system to highlight key issues that are relevant for the company. These are then highlighted and mapped for the relevance of the benchmarks and ease of implementation as highlighted below.

With this clear action plan to tackle remaining gaps, companies can then turn inwards to work with internal stakeholders to advance further on closing gaps and ensure that the efforts put into reporting yield positive impacts on key benchmarks and further accelerate ESG progress within the organization.

To learn more about the ESG Streamliner Tool, and take advantage of summer to prepare for your next reporting cycle, you can download the service description here and to further discuss how to make the most of the array of benchmarks to mobilize your sustainability action, please contact us hello@finchandbeak.com or call +34 6 27 78 81 70.

Photo by Winston Chen on Unsplash

Finch & Beak

hello@finchandbeak.com

+34 627 788 170