Finch & Beak is now SLR Consulting, a global organization that supports its clients on setting sustainability strategies and seeing them through to implementation.

We invite you to check out the SLR website, so you can see the full potential of what we offer, from sustainability strategies to implementation covering Climate Resilience & Net Zero, Natural Capital & Biodiversity, Social & Community Impact, Responsible Sourcing and more.

The European regulatory environment is playing an accelerator-role towards the integration of sustainability issues into the core business of insurance companies. Realizing the impact of this, the European Commission has recently amended the Solvency II Directive, which introduces obligations for insurers to manage sustainability risks and ensure that sustainability issues are taken into account during the identification, measurement, monitoring, controlling and reporting of assets risks, considering the best interest of policyholders (Prudent Person Principle'). The new requirements under the Solvency II Directive is a clear step by the European Commission toward integrating the concept of Double Materiality into the business strategies of insurance companies, considering both the inside-out and outside-in impact related to the material sustainability factors of the sector.

The Directive 2009/138/EC (Solvency II Directive), followed by the Delegated Regulation (EU) 2015/35 (Solvency II Delegated Regulation), is a key law that codifies and harmonizes the EU insurance regulations. Solvency II sets out requirements applicable to insurance and reinsurance companies in the EU with the aim to ensure the adequate protection of policyholders and beneficiaries.

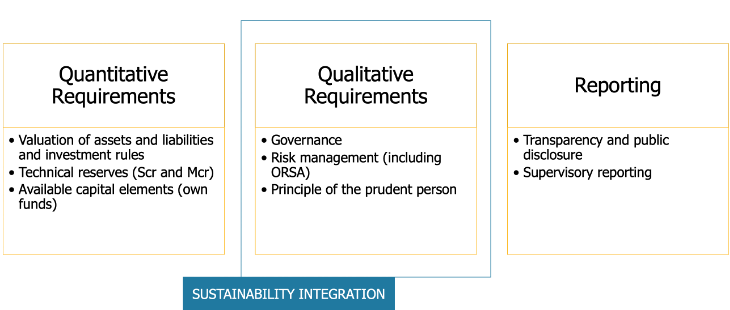

This law plays a crucial role in the business continuity of the European insurance industry, and its three-pillar structure, with quantitative, qualitative and reporting requirements, provides insurance companies with the appropriate holistic system and tools to ensure such continuity.

With the European Commission’s increasing awareness that business continuity is related to sustainability issues, it has decided to integrate these issues and leverage the significance of this Directive through the development of the Delegated Regulations (EU) 2021/1256 (amending Delegated Regulations), which adds new requirements, and amends some of the existing ones, with regards to sustainability risks and factors in the areas of risk management and governance systems.

This regulation will become enforceable on 2 August 2022 with insurance companies subject to Solvency II required to:

The European Commission is aiming to align all new regulations with regards to sustainability aspects with the 'dual materiality' approach, a key principle of the Corporate Sustainability Reporting Directive (CSRD) - a new non-financial reporting Directive. By applying this approach, it is in fact possible to have a 360-degree view of the relationship between business and sustainability. A materiality assessment can therefore be a functional tool for the integration of new sustainability requirements related to Solvency II, especially in the 'identification' phase of risks and impacts.

Using the double materiality approach as part of the materiality assessment can help insurance companies understand, through a qualitative and quantitative assessment, what the impact of relevant sustainability issues are on investment and insurance underwriting (outside-in perspective). At the same time, it can help them understand, applying a forward-looking perspective, what the long-term impacts of their investment strategies and insurance products on sustainability factors (inside-out perspective) are.

To unlock the potential of a materiality assessment, insurance companies will have to ‘customize’ this activity incoroprtaing the new Solvency II requirements.

Interested in knowing more about how the insurance sector in Europe is integrating sustainability in their business? Finch & Beak recently conducted a comprehensive benchmark study to determine how 25 featured companies are advancing on ESG topics. Use the button below to request a meeting to discuss the full report.

If you are considering updating your materiality assessment into a forward-looking matrix, that covers double materiality, as well as sustainability risks get in touch with Johana Schlotter, at johana@finchandbeak.com or call +31 6 28 02 18 80 to learn how Finch & Beak can support you to accelerate your sustainability strategy.

Photo by Guillaume Përigois on Unsplash

Finch & Beak

hello@finchandbeak.com

+34 627 788 170