Thank you for visiting the Finch & Beak website. Finch & Beak is now part of SLR Consulting, a global organization that supports its clients on setting sustainability strategies and seeing them through to implementation.

This is an exciting time for us, as our team now includes an array of new colleagues who offer advisory and technical skills that are complementary to our own including Climate Resilience & Net Zero, Natural Capital & Biodiversity, Social & Community Impact, and Responsible Sourcing.

We would like to take this opportunity to invite you to check out the SLR website, so you can see the full potential of what we are now able to offer.

After conducting a portfolio sustainability analysis (a quantitative and qualitative assessment of the performance, policies in place, and overall strategy of these 25 companies), it is possible to conclude that amongst those companies analyzed, Allianz, Zurich Insurance Group, and Swiss Re are the market leaders in terms of adapting quickly to the market demands for ESG integration into strategy. These industry leaders have included climate change and ESG integration in their insurance practices, set forward-looking targets and commitments, developed concrete sustainable insurance options, and worked on greening the company’s investment portfolios. Key highlights from this thorough investigation into the overall trends of the industry are outlined below.

Materiality assessments are an important point for the insurance industry to address as double materiality assessments will eventually be required by the CSRD. While 88% of companies have taken steps to have a materiality assessment in place and have defined climate change, responsible investing, and customer care and satisfaction as the most material topics, few have done this by implementing a double materiality assessment. Based on our analysis, only 18% of insurance companies are conducting double materiality assessments which involves taking an approach that assesses both the outside-in and inside-out impacts of a company.

The industry is strongly unified in disclosing Scopes 1-3 emissions publicly, but oftentimes, these reports of Scope 3 emissions did not include disclosures on the investment portfolio of the company. In an interview with Lucia Silva, Group Head of Sustainability and Social Responsibility at Assicurazioni Generali she shared with us that “assessing the emissions of investments is the biggest challenge because of the time gap between when companies provide their data and when investors need them.” This is a big challenge for the industry to confront as various carbon accounting tools do not even seem to yield the same results and the Science-Based Target Initiative has yet to publish a framework for the financial services industry. In the meantime, companies are utilizing impact measurement and valuation assessments to determine where the environmental and social impacts are located.

One of the ways that an insurance company can drive change on its impact is through the incorporation of exclusions into the underwriting and investments processes. While this practice is clearly in place for companies as it relates to their investment portfolio, it is not as clear in the insurance underwriting process. Only slightly more than 1 in 4 companies in the analyzed sample set had a clearly outlined process for integration of ESG into their insurance underwriting processes. S&P Global’s new criterion “Decarbonization Strategy” for the insurance industry confirms the trend and emphasizes the growing demand companies will face incorporating exclusions into both their investment and insurance underwriting policies.

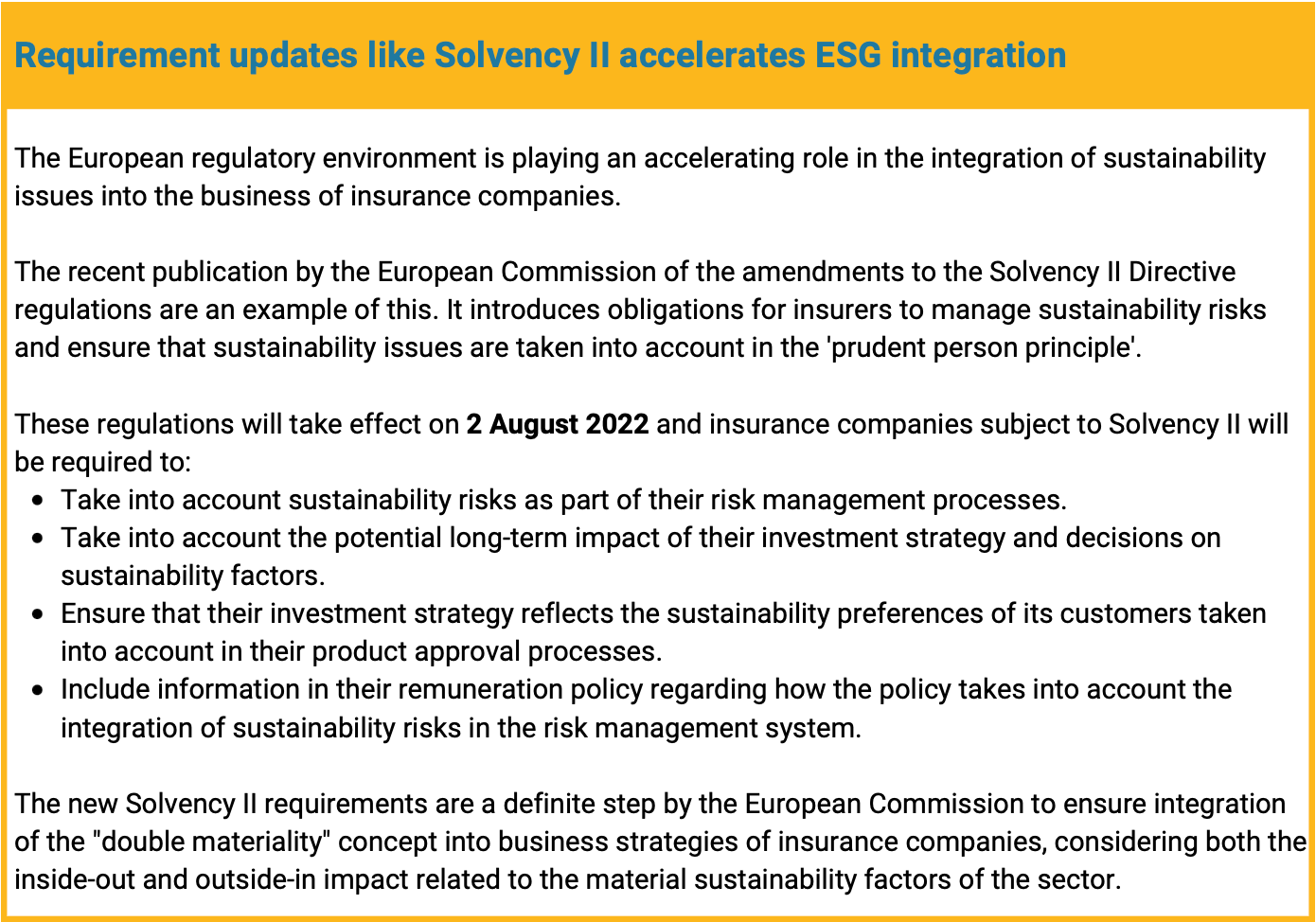

Considering the governance dimension, it is evident that the insurance industry is striving to integrate ESG metrics into executive remuneration. Viewed by investors and investor-based ratings such as S&P Global as key for accelerating sustainability performance this practice moreover is signaling a commitment to stakeholders. The analyzed sample illustrates though, that only 56% of the sample’s ESG metrics are already connected to executive remuneration with another 8% planning to connect ESG metrics to executive remuneration in the next years. To best align with the expectations of key stakeholders, companies will have to align their sustainability strategies with long- and short-term incentive plans and ensure a strong connection between ESG metrics and executive remuneration.

While studies report that the share of women in the workforce in financials decreased to around 47%, the insurance industry has an average of 50% of women in the company when looking across the entire team. The gender breakdown in management positions looks different though: the insurance sample set reports that women only account for 31% of management positions. To overcome the lack of gender balance it is key to have a clear diversity and equal opportunities strategy that focuses on gender balance, enhanced by concrete actions to support this goal: ensuring gender balance in leadership development programs, gender-neutral hiring policies, flexible work policies, and parental leave policies that are in excess of the legal requirement.

An important and encouraging conclusion is that the insurance industry is moving in the right direction, responding to risks, and stakeholder demands. There seems to be a distinction however between the leaders who are moving at a faster pace while the laggards are slower to integrate important ESG themes into their overall strategy. A materiality assessment can be a crucial starting point to highlight the most important stakeholder and company issues to prioritize. With these issues defined, a company can activate and become part of the leaders who push for further integration of ESG themes.

Learn more about the group analyzed, how Insurance industry peers' performance compares, learn from industry leaders and and find out how Finch & Beak can help your organization activate its ESG performance by requesting a 30-minute call to discuss the report, using the button below.

Photo byJonathan Fordon Unsplash

Sustainability professional aiming to help companies implement practical strategies yielding positive ESG results. claire@finchandbeak.com

Finch & Beak

hello@finchandbeak.com

+34 627 788 170