Thank you for visiting the Finch & Beak website. Finch & Beak is now part of SLR Consulting, a global organization that supports its clients on setting sustainability strategies and seeing them through to implementation.

This is an exciting time for us, as our team now includes an array of new colleagues who offer advisory and technical skills that are complementary to our own including Climate Resilience & Net Zero, Natural Capital & Biodiversity, Social & Community Impact, and Responsible Sourcing.

We would like to take this opportunity to invite you to check out the SLR website, so you can see the full potential of what we are now able to offer.

Until 2020, the CSA was mostly aimed at a restricted number of DJSI-eligible companies and their stakeholders. Since taking over the ESG ratings and benchmarking arm from RobecoSAM at the end of 2019, S&P Global has widely extended the reach and application of the CSA. The CSA is now an even more elaborate process which is used to determine companies’ ESG Scores and, where applicable, inclusion in indices.

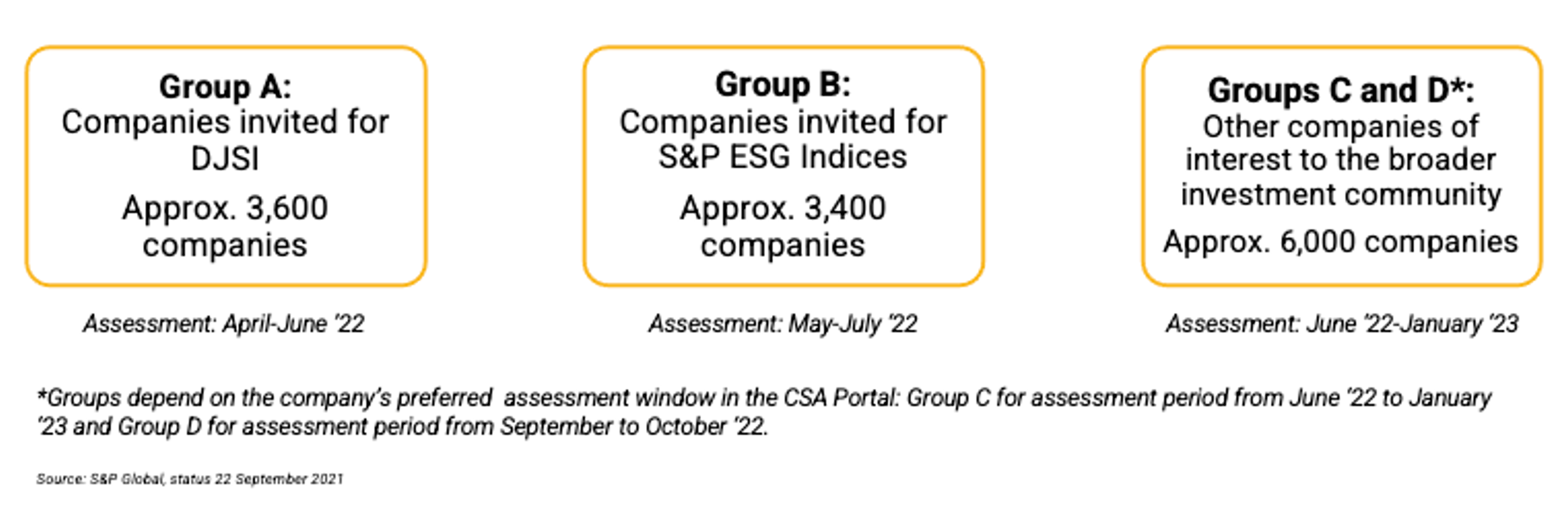

As a result, in 2022 over 11,000 companies have been invited to participate in the CSA, which are divided into distinct groups with different timelines. These companies are assessed based on public data or based on their active participation in the CSA. For 2022, the four groups of companies invited to participate in the CSA are as follows:

Companies can check their invitation status, and to which group they belong on S&P Global’s webpage.

Reflected in the number of companies that are actively participating in the assessment, it is evident that more companies are seeing the value in participating in the CSA, with the participation rate doubling since 2020. Around 2,800 companies participated actively in the CSA 2022, up from 2,270 in the 2021, and 1,386 in 2020. In fact, participating companies now represent half of the global market capitalization, with the main participation from the Europe, the Middle East, and Africa region, followed closely by North America.

S&P Global explained that the CSA 2022 results will be announced in waves given the increasing number of companies being assessed in the CSA, and the different assessment timelines for different groups of companies. This new approach, which allows companies to receive their ESG Scores as early as possible, has several benefits for companies including:

The results will be announced starting on 23 September 2022 for the first wave of results, and every third Friday of the month thereafter, until the end of March 2023. From the first wave, approximately 45% of target submissions will be assessed, of which approximately 1,300 survey respondents and 2,600 assessments performed by S&P Global analysts based on publicly available information.

One important difference compared to previous years, is that companies eligible for the Dow Jones Sustainability Indices will only know about their inclusion in the DJSI on Friday 9 December 2022, and not at the same time as when receiving their ESG Scores.

The main announcement dates relevant for DJSI-eligible (Group A) companies are:

The main announcement dates relevant for S&P ESG Indices-eligible (Group B) companies are:

ESG Scores for the other companies which are part of Groups C and D will be available from Q1 2023, based on CSA submission dates.

S&P Global’s approach to releasing results in waves comes with a new feature in the CSA portal, on the Benchmarking page. Companies can now select different features including the base year (the year with which they would like to compare their performance in the CSA), the strategic peer group to use for benchmarking purposes (based on region/country, index, and industry/peer group) and whether or not to include a mix of CSA 2021 and 2022 scores.

Including CSA 2021 scores for those companies whose CSA 2022 scores are still pending is beneficial in benchmarking as it allows to consider the expected performance of those companies who have not yet been scored, using the most accurate available expectation of their CSA 2022 performance. As such, companies can better understand which industry peers are likely to be still performing better than them, or not. However, using the CSA 2021 scores should only be done for estimation purposes as the CSA 2021 scores do not reflect companies’ ESG performance in 2022.

Moreover, companies can decide which strategic peer group they consider when assessing their score statistics (i.e. percentile ranking, average, and best scores) by selecting the relevant region/country, index, and industry/peer group and including CSA 2022 scores for accurate comparability. S&P Global explained that this new approach to benchmarking allows resolving some of the former challenges encountered from using an anchor universe in the score statistics.

This new approach has implications on how companies can read and communicate their ranking performance. S&P Global used the metaphor of a skiing competition: when a skier finishes a race, she will know her score and therefore absolute performance, but not yet her performance relative to her peers still uphill, until these finish the race and obtain their scores. The same goes for companies in the CSA 2022.

Therefore, a company’s performance in the CSA 2022 can only be adequately compared to a well-defined strategic peer group whose CSA 2022 scores are available. S&P Global further explains that companies should not use comparative rankings or refer to other companies until all relevant companies in the selected peer group have obtained their CSA 2022 results. To compare performance relative to those companies who already have a CSA 2022 score available, companies should clearly indicate which companies are included in the comparison. More guidance on communicating results is available on S&P Global’s Tutorials webpage.

With over 15 years of experience in ESG Benchmarking support including the CSA and CDP, Finch & Beak is one of Europe’s leading experts in improving our clients’ sustainability programs and ESG performance, including support on double materiality, sustainability governance, and TCFD implementation.

If your organization is looking to accelerate its sustainability performance, please contact Johana Schlotter, at johana@finchandbeak.com or call +31 6 28 02 18 80.

Photo by Ethan Walsweer on Unsplash

Finch & Beak

hello@finchandbeak.com

+34 627 788 170