Thank you for visiting the Finch & Beak website. Finch & Beak is now part of SLR Consulting, a global organization that supports its clients on setting sustainability strategies and seeing them through to implementation.

This is an exciting time for us, as our team now includes an array of new colleagues who offer advisory and technical skills that are complementary to our own including Climate Resilience & Net Zero, Natural Capital & Biodiversity, Social & Community Impact, and Responsible Sourcing.

We would like to take this opportunity to invite you to check out the SLR website, so you can see the full potential of what we are now able to offer.

The most important first step is to start by aligning on what do we mean by sustainability. Way too often still, the term is confused with ESG. If using terms such as climate strategy, physical risks, double materiality and stranded assets do not echo in the boardroom, the discussions are likely to remain still. For every board member to stay – and feel – involved throughout the board’s decision-making process, it all starts with a training (see recommendation at the bottom of the article).

The numerous ESG issues might well discourage the board to get started. There are 17 SDGs, one company alone can’t contribute to them all. There are often up to 50 material items that will affect a company’s future, one can’t address them all either. That is where your double materiality assessment comes in, required by new regulations such as the Corporate Sustainability Reporting Directive (CSRD) for a broad set of ESG topics and the Task Force on Climate-related Financial Disclosures (TCFD) dedicated to environmental disclosures.

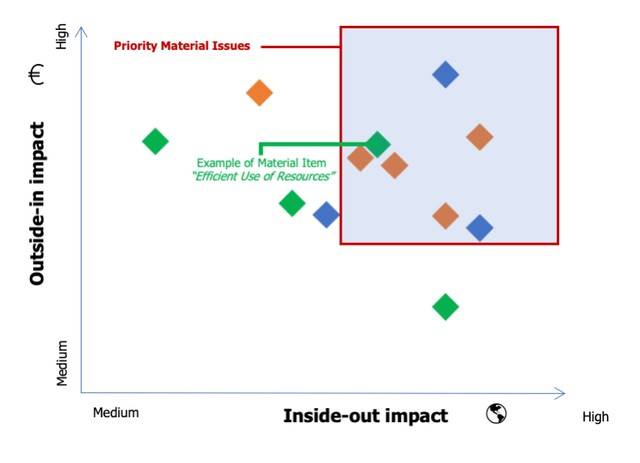

It helps identify and prioritize the critical non-financial issues the board should focus on. In fact, the double materiality assessment extracts the core ESG drivers that will impact your business (“outside-in”), that can actually serve as a valuable input for the board’s risk management approach. At the same time, it also helps evaluate your company’s impact on society and the environment (“inside-out”). The process is highly stakeholder centric thanks to multiple qualitative stakeholders interviews. It is an efficient way to align to what matters to those stakeholders and thus preempting pressures and aligning all interests.

The materiality matrix – core outcome of your double materiality assessment – gives the board a prioritization roadmap. What falls on the top right quadrant of the matrix are some of the most critical items, which the board can actively consider in their decision making. Yet, a materiality matrix might not be a familiar tool to all board members. To address this challenge, you can also use our resources extracted from Jan van der Kaaij’s book to help them familiarize with the topic.

Back to the most material items of the matrix, it is often helpful to speak of those from the perspective of risks and opportunities when addressing the board.

Let’s take for example the Efficient Use of Resources (taken from the materiality matrix one of our clients in the food industry). Throughout the materiality assessment, this item was discussed as presenting an important risk to the company, when unmet. Do we find it in the company’s risk map? At the same time, Efficient Use of Resources also represents an opportunity for the company, if achieved. Does it belong to the company’s strategic business drivers? Identifying business priorities using the outcomes of the double materiality assessment is thus a convincing way of reconciling the two.

Bringing in the ESG opportunity & risk conversation enhances the importance to integrate it to the board’s agenda. On the other hand, because ESG is subject to rapidly evolving regulations, it often also appears as a pain point. The parallel with accounting might help here. Accounting sounded like a pain point too when first introduced. Today, management accounting represents the most important tool for your business to drive strategy and value creation. Eventually, the core elements of non-financial reporting will follow the same path, accelerated by the CSRD. It is just a matter of which elements of non-financial reporting to use, and how to use them beyond reporting. In that sense, boards have a chance to start using ESG to drive the long-term strategy of the company.

All in all, recent crises and subsequent development of board members’ accountability represents the perfect timing to engage the board in seeking alignment between the company’s priorities and the sustainability agenda. With an educated board and well defined sustainability priorities – defined by stakeholders from both a risk and opportunity perspectives – the moment is well chosen to diffuse in the boardroom the desire to become a sustainability champion.

Recommended external material on the topic: - Our recommended training: IMD’s Driving Sustainability from the Boardroom Program |

Finch & Beak

hello@finchandbeak.com

+34 627 788 170