Thank you for visiting the Finch & Beak website. Finch & Beak is now part of SLR Consulting, a global organization that supports its clients on setting sustainability strategies and seeing them through to implementation.

This is an exciting time for us, as our team now includes an array of new colleagues who offer advisory and technical skills that are complementary to our own including Climate Resilience & Net Zero, Natural Capital & Biodiversity, Social & Community Impact, and Responsible Sourcing.

We would like to take this opportunity to invite you to check out the SLR website, so you can see the full potential of what we are now able to offer.

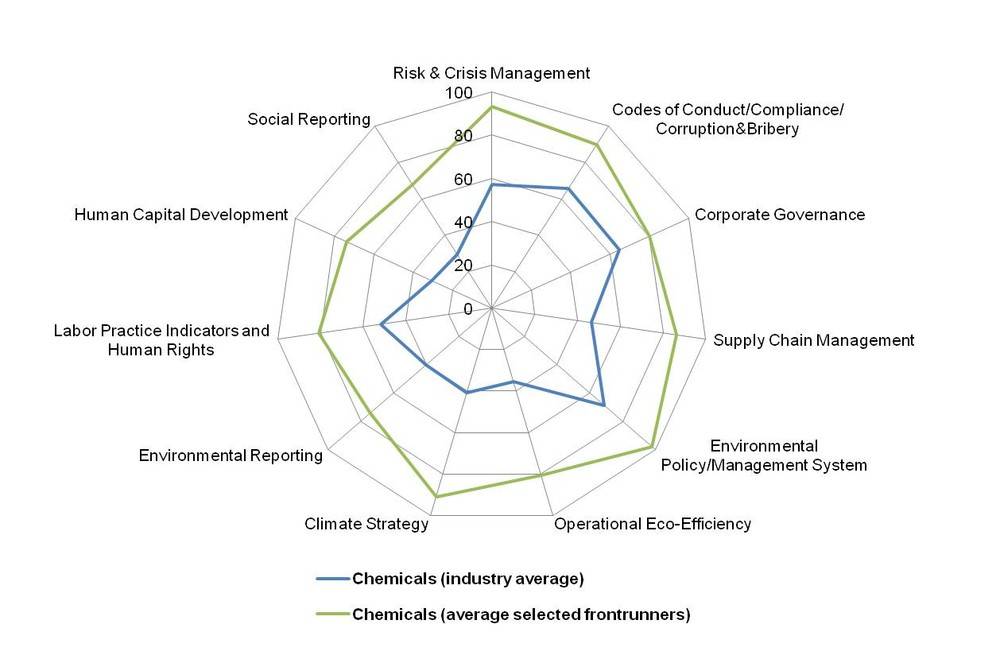

We compared the performance of 6 sustainability frontrunners (AkzoNobel, Royal DSM, Solvay, Clariant, Umicore and BASF) with the industry average. The three main take-aways:

As an industry that used to be perceived as harmful for its workers, the environment and local communities, the chemicals sector has shown a clear commitment in recent decades by taking more responsibility for its economic, environmental and social impact. Research shows that having a solid sustainability program aligned with the business leads to better bottom-line results, increased access to capital and significant cost reductions.

To help us create insight in the sustainability performance of the chemicals sector, RobecoSAM compared the consolidated scores of six leading chemicals companies (AkzoNobel, Royal DSM, Solvay, Clariant, Umicore and BASF) to the industry-wide averages of the Corporate Sustainability Assessment (CSA) of 2014. The graph below shows the results.

Source: RobecoSAM

When we take a closer look at the scores, a number of interesting conclusions can be drawn. It is clear that the selected frontrunners outperform the industry on all criteria. The gap is significant: on average, the score of the selected frontrunners is 83% higher than the industry average.

On the economic dimension, the gap between the frontrunners and industry average is the smallest. Particularly on the well-regulated criteria of corporate governance and codes of conduct/compliance/corruption & bribery, the industry average score is relatively high.

However, this does not mean performance on all economic criteria is at an equal level. Where the industry performs moderately on the risk and crisis management criterion, the front runners seem to have made this a priority in order to secure the future of their businesses and therefore perform extremely well on this item. In the area of supply chain management, the gap between frontrunners and the industry is also large. These seem to be issues of strategic value that are recognized as such by frontrunners, but not yet within the entire chemicals industry.

While the majority of companies in the chemicals industry seem to have adopted some sort of environmental policy or management system, they yield varying results. Frontrunners obtain scores that are more than twice as high as the industry average in the area of operational eco-efficiency, and the gap for companies that have adopted a climate strategy is even more extreme. Frontrunners seem to have made it their priority to structurally reduce their environmental impact, while the industry still lags behind.

Within the social dimension, we see a pattern comparable to that in the economic dimension. The compliance-driven criterion of labor practice indicators and human rights shows a moderate industry-wide score, while leading companies perform good, but not great. However, the most distinctive gap of the entire graph can be found on the issue of human capital development. While leading chemical companies have started to catch up and see the value of developing their human capital, this notion seems to have not yet sunk in on an industry-wide level.

A final word can be said about the apparent lack of maturity of sustainability reporting in the chemicals industry. In the areas of environmental and social reporting, even the front-running companies note their lowest scores. While transparency on environmental processes and impact seems to have become a little more advanced, social reporting in particular receives little attention in an industry driven by material and financial capital. With the increased adoption of GRI G4 and integrated reporting, we expect the chemicals industry to grow into a more balanced look on materiality, and to start showing increased transparency and accountability towards stakeholders.

Concluding from this industry analysis, what seems to set the frontrunners apart from the herd is a strategic focus on sustainability as a key driver. They approach sustainability as an opportunity for value creation, and not just a set of measurements in order to comply with regulation.

Two factors are key in coming towards a strategic focus on sustainability:

Is your company still in the herd, or has it already made the leap into becoming a frontrunner in sustainability?

Whether you want to increase the results of your sustainability program to stay ahead of the crowd, take the leap to reap the benefits of having a strong sustainability strategy, or have an interest in integrated reporting, Finch & Beak can help. Please contact Nikkie Vinke, Senior Consultant, at nikkie@finchandbeak.com or call +31 6 28 02 18 80.

Image source: Laica ac/Flickr

Seasoned advisor in ESG benchmarking, sustainability strategy and stakeholder engagement. | nikkie@finchandbeak.com

Finch & Beak

hello@finchandbeak.com

+34 627 788 170