Finch & Beak is now SLR Consulting, a global organization that supports its clients on setting sustainability strategies and seeing them through to implementation.

We invite you to check out the SLR website, so you can see the full potential of what we offer, from sustainability strategies to implementation covering Climate Resilience & Net Zero, Natural Capital & Biodiversity, Social & Community Impact, Responsible Sourcing and more.

The materiality matrix has become a familiar sight in corporate reporting. Unfortunately, proper design and use of the tool is still not common practice. In most cases it represents a selection of topics that generate impact on the company and that are relevant to its stakeholders, but interesting (and not so interesting) mutations are also found frequently.

Finding and using materialities in a productive way requires a transparent and thorough process in order to avoid misinterpretation. For example, Dow Jones Sustainability Index Industry Group leader Swiss Re addresses this clearly in its 2014 Corporate Responsibility Report: “Materiality has been a key topic in recent discussions about corporate responsibility reporting. It is our impression, however, that not everyone understands this term in the same way. Some stakeholders define materiality as all of a company’s actions that impact the environment and society; others narrow down materiality to those aspects that have a tangible link to a company’s financial performance. These two notions of materiality lead to significant differences in reporting focus and scope. This is why we have started to provide an extended chapter on corporate responsibility in our Financial Report that focuses on actions with a strong link to our financial performance.”

Apart from struggling with definition issues which illustrated in the Statement of Common Principles of Materiality of the Corporate Reporting Dialogue (refer to download), the innermost intricacy that is found in materiality matrices is that they are defensive by design and as a result, are insufficiently looking for opportunities. In many cases, the definition of the “impact-axis” of the matrix predominantly covers risk while the chances for eco-efficiencies or innovations are overlooked. As a result, companies end up with a materiality matrix that is viewed and applied as a stand-alone reporting tool that is not embedded in the business strategy design process.

Making the materiality matrix more relevant to the board essentially means reframing it in core business terminology; away from the green jargon. This can be as simple as mapping the company’s strategic must-win battles with the identified material issues.

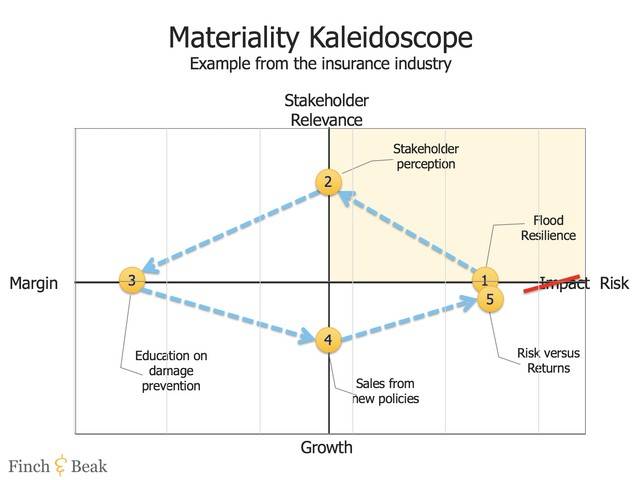

A more telling and elaborate way of engaging the board is developing the materiality kaleidoscope: a decomposition of the matrix itself by splitting the somewhat vague “impact-axis” into three distinct, recognizable elements: Risk, Margin Improvement and Growth Potential.

Let’s look at a simplified step-by-step case from our practice sourced from the insurance industry as an illustration.

By repeating this process for the other relevant materialities (such as the changing demand in mobility), a future value of the transitioning process can be estimated and presented.

Viewing materialities as an opportunity not only requires a different mindset, but also tools and stamina. In the words of Swiss Re: “We address sustainability, political, regulatory and emerging risks in our core business transactions. To do so, we have developed specific tools and know-how.”

Of course not all materialities are as easy to assess, and sometimes benefits from growth and margin improvements can be found in more unlikely places. The 2014 Harvard Business Review article “Sustainability a CFO Can Love” by Kurt Kuehn, Chief Financial Officer at UPS, provides some strong suggestions where to look for benefits, for instance by generating lower-cost access to cash, materials, or supplies on a sustainable basis, or by leveraging the existing stakeholder network. As it appears, innovations from sustainability, whether they are sustainability-relevant, sustainability-informed or sustainability-driven, come in many shapes and sizes.

Finch & Beak has 20 years of experience in generating value from sustainability. Should you be interested in applying the materiality kaleidoscope at your company, or in exploring other opportunities for sustainable innovation, please contact us at hello@finchandbeak.com for more information.

Photo by Malcolm Lightbody on Unsplash

Finch & Beak

hello@finchandbeak.com

+34 627 788 170