Thank you for visiting the Finch & Beak website. Finch & Beak is now part of SLR Consulting, a global organization that supports its clients on setting sustainability strategies and seeing them through to implementation.

This is an exciting time for us, as our team now includes an array of new colleagues who offer advisory and technical skills that are complementary to our own including Climate Resilience & Net Zero, Natural Capital & Biodiversity, Social & Community Impact, and Responsible Sourcing.

We would like to take this opportunity to invite you to check out the SLR website, so you can see the full potential of what we are now able to offer.

A couple of years back the BlackRock’s Scientific Active Equity team found that U.S. companies with higher climate scores tend to be more profitable and generate higher returns on assets. Selecting a portfolio that was biased on CO2 performance, chosen from Russell 3000 Index companies, the weighted average of CO2 emissions came out almost 50% below the benchmark average. Financially, this same portfolio selection outperformed the Russell benchmark by as much as seven percentage points. Similarly, research on the Dow Jones Sustainability Index data shows that sustainability leaders outperform their industry average by as much as 25% and the differences between industries are as high as 36%. What can fast-followers do to close the gap and increase their appeal to investors?

In the run-up to the recent UN Climate Summit in Katowice Poland, governments were encouraged to bring their A-game by business leaders from around the globe. Shortly before the Summit, the Alliance of Climate Action CEOs, a group of leaders of 50 major global businesses brought together by the World Economic Forum, published an open letter to governments demanding better collaboration to accelerate outcomes in the race against climate change. In their appeal the CEOs, jointly representing more than $1.5 trillion in total revenue, emphasized the importance of partnering and public-private cooperation.

The CEO’s, touted as first movers in sustainability, stressed the importance of the business case for cutting emissions to generate wider support in the private sector. Moreover, better public-private cooperation was demanded to accelerate effective carbon pricing mechanisms and policies that incentivize low-carbon investment and drive demand for carbon-reduction solutions.

“Business has an increasingly vital role to play in accelerating the shift to a low-carbon and climate-resilient economy. This will require partnerships with other companies, governments at all levels and civil society. It also requires bold leadership and good governance, which will allow long-term creation of shareholder value alongside long-term value for our society. We, as business leaders, are committed to climate action and stand ready to facilitate fast-track solutions to help world leaders deliver on an enhanced and more ambitious action plan to tackle climate change and meet the goals set out at the 2015 Paris Climate Agreement”, said Feike Sijbesma, Chief Executive Officer and Chairman of the Managing Board, Royal DSM, and Chair of the Alliance of CEO Climate Leaders.

During the UN Climate Summit, negotiators from around the globe worked for two weeks on the Katowice Climate Package, aimed at implementing the Paris Agreement. After two weeks of hard work and tough negotiations, the COP24 as the UN Climate Summit is also called, resulted in almost 200 countries signing a complex rule book for the implementation of the Paris Climate Agreement.

After the summit, experts remained uncertain if the results from COP24, described by some as “we did what was possible, not what was needed”, are sufficient to stay within the 2 degrees scenario of the Paris Climate Agreement. More disturbingly, in its most recent report the IPCC states that carbon pollution must be cut almost in half by 2030, in order to avoid 1.5 degrees of warming, and then reach "net zero" by mid-century. This latest increased objective requires an even more drastic review of measures by global industries and governments.

With the battle for sustainability heating up, banks such as ING and DBS are already rolling out sustainability-performance-linked loans to align their portfolio with the Paris Agreement 2 degrees scenario. Big investors are increasingly factoring in sustainability performance in their investment decisions and the investment community has been advancing its approaches for the valuation of impact making the sustainability performance more measurable. In parallel, according to Worldbank figures, carbon pricing is on the rise raising the cost for carbon inefficiency. As BlackRock, the globes biggest investment firm concludes: “There can be little downside to gradually incorporating climate factors into the investment process — and even potential upside.”

In the annual composition of the Dow Jones Sustainability Index (DJSI), the climate strategy criterion is one of more than 20 criteria that make up the full assessment as compiled by DJSI composer RobecoSAM. Sustainability leaders such as the companies represented by the 50 CEOs are clearly ahead of their sector average, outshining their peers in “green appeal” to investors. Comparing the average score on climate strategy with the marks of the top performers over the three-year research period, demonstrates that on average sustainability leaders outperform industry averages by 16%.

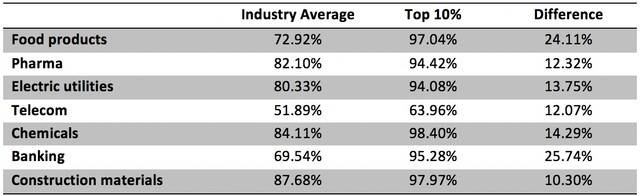

Table 1. Scoring on climate strategy criterion, 2015–2017 Dow Jones Sustainability Index, all companies, selected industries

Even more striking is the difference in performance when comparing the selected industries with each other; the scores of the highest-scoring industry (Construction Materials) and lowest-scoring industry (Telecom) differ 36%, on a topic that is recognized as being highly relevant for both industries.

While most companies zoom in on the eminent risks associated with a changing climate and are sometimes tempted to divert their attention to other sustainability issues, sustainability leaders were found to proactively seek and seize the business case linked to climate change. In part this explains the striking score differences between those sustainability leaders and their sector average.

In anticipation of increasing unavoidable measures and investors increasingly regarding climate strategy as an indicator of future profitability, companies and executives must develop a new sense of urgency, moving their sustainability programs from the realm of compliance and iterative improvements to that of a key driver of performance and innovation, which requires embedding it more deeply into their core strategies. The time for defensive approaches in broad sustainability programs with great stories is rapidly passing. It is time to focus on core sustainability issues and show results.

What are the takeaways for businesses that do not belong to this exclusive group of 50 sustainability leaders that are so willingly raising the bar? Recent research from IMD business school in Lausanne proposes that companies should implement a combination of direction and speed as already applied by sustainability leaders such as Unilever, Lenzing, Umicore, DSM and Novozymes. In the associated book encompassing the research, Winning Sustainability Strategies by professor Benoit Leleux and Executive in Residence Jan van der Kaaij, this design and implementation of a stronger sense of focus, is dubbed Vectoring. In order to move their sustainability programs forward more rapidly, businesses are counselled to focus almost exclusively on those relevant material sustainability topics that are impacting core business, for instance the topic of climate change for the chemicals industry and energy sector or forced labor in the cocoa supply chain.

With the sustainability pressures on our planet and our businesses mounting, it is high time to prune many of the existing CSR initiatives, enabling the advance of tangible results from the remaining core issues. In business strategy, focus is required to obtain the best results and clearly sustainability strategy is no exception. Climate change means business, tomorrow even more so than today.

For the World Economic Forum's article "Globalization 4.0 will help us tackle climate change. Here’s how" click here.

Finch & Beak

hello@finchandbeak.com

+34 627 788 170