Thank you for visiting the Finch & Beak website. Finch & Beak is now part of SLR Consulting, a global organization that supports its clients on setting sustainability strategies and seeing them through to implementation.

This is an exciting time for us, as our team now includes an array of new colleagues who offer advisory and technical skills that are complementary to our own including Climate Resilience & Net Zero, Natural Capital & Biodiversity, Social & Community Impact, and Responsible Sourcing.

We would like to take this opportunity to invite you to check out the SLR website, so you can see the full potential of what we are now able to offer.

Real estate’s environmental impact is significant: in Europe, buildings accounted for 40% of total energy consumption in the year 2017. Furthermore, the amounts of energy and resources, such as sand, gravel and cement required for the construction, use and renovation of buildings were reason for the real estate and construction industries to be pointed out in the EU Green Deal.

The Real Estate industry overview in S&P Global’s Sustainability Yearbook 2021 displays 35 leading companies that score within 15% of Dexus, the Australian industry leader. An astonishingly low number of only 5 of those companies originate from Europe. This suggests that European real estate companies are lagging behind on sustainability.

The most recent GRESB Real Estate Assessment, a global ESG benchmark for the real estate industry, showed a similar geographic disparity. In 2020, participating European companies demonstrated an average performance of 69.5 points, just ahead of the Americas (average 69 points) but outperformed by Oceania (77) as well as the Asian real estate sector (72).

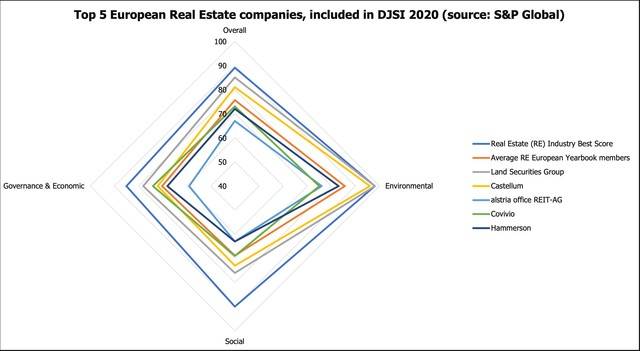

Taking a closer look at the previously mentioned five European companies that are included in the Sustainability Yearbook, there are clues where the performance gap is most prevalent. Publicly available data demonstrate that the five companies all have a strong result on the environmental dimension of S&P Global’s Corporate Sustainability Assessment (average: 83 points) but show much weaker outcomes on the social and governance & economic dimensions (respective average scores of 69 and 70 points).

At the criterion level, the five companies grouped together have 70 or fewer points on average on Risk & Crisis Management, Supply Chain Management and Stakeholder Engagement. This suggests that they may struggle to foresee emerging risks, effectively manage their suppliers, or lack stakeholder management mechanisms that strengthen the company’s resilience and reputation.

At the environmental level, biodiversity appears as greatly unchartered territory, where Hammerson is the only company with a decent score, 75, while Covivio scored 6 points and Land Securities Group, Castellum and alstria office REIT-AG did not receive any points at all.

Gender diversity also seems to be an issue for the industry. Across the five companies, a share of 22% women can be counted at the executive management level. Excluding Castellum, the Swedish company with a 50/50 gender split in its Executive Management Group, the average of female executives of the four remaining companies even drops to 15%.

These observations suggest that European real estate companies may be vulnerable to increasing ESG scrutiny (beyond their portfolio’s environmental performance) from investors, policy makers and other stakeholders, or that they may lose out on the opportunities presented in the green financing realm – especially when they are competing with global peers.

According to SEB, governments and companies are expected to issue $500 billion in green debt in 2021, nearly half the total that has been raised since green debt was introduced. With added growth from new sustainable loan types, SEB states that 2021 could see more than $1 trillion raised for sustainability-labelled financing.

As real estate companies want to tap into this source of financing, they will need to demonstrate a mature, more balanced ESG approach. On the more operational, environmental side that may already be feasible today, However, European real estate companies are also challenged by their stakeholders to take a wider look along, along their value chains both upstream (sourcing of materials, biodiversity impacts) and downstream (energy consumption of tenants, affordable housing), as well as towards the internal organization. This still seems to be a challenge.

At current, green bonds and loans in the real estate industry are largely focused on reducing carbon emissions from buildings, feeding investments into improving energy efficiency and realizing on-site renewables. However, examples of a broader view on ESG are already present today as well.

In April 2018, office real estate investment trust Gecina signed a €150m Sustainability Improvement Loan with ING France, with its margin depending, among others, on its GRESB rating. Progress is measured through GRESB by benchmarking Gecina’s performance against its peers through a customized package of different ESG indicators, consisting not just of environmental, but also social and governance aspects.

At the launch of the loan, Gecina’s CEO Méka Brunel commented: “With this sustainable improvement loan, Gecina demonstrates its strong CSR convictions by integrating social and environmental concerns on an equal footprint with financial targets. CSR is fully integrated in our strategy and our business. Future is about leveraging the power of this integration and sustainable finance is a new step in this direction.”

So, what can real estate companies do to overcome the hurdles, lay the foundation for a more balanced sustainable business and be better positioned to tap into sustainable financing opportunities? These three steps will go a long way.

If your company is looking to strengthen its sustainability performance, please contact Johana Schlotter at johana@finchandbeak.com or +31 6 28 02 18 80 on how Finch & Beak can help you overcome risks and seize opportunities.

Seasoned advisor in ESG benchmarking, sustainability strategy and stakeholder engagement. | nikkie@finchandbeak.com

Finch & Beak

hello@finchandbeak.com

+34 627 788 170