Thank you for visiting the Finch & Beak website. Finch & Beak is now part of SLR Consulting, a global organization that supports its clients on setting sustainability strategies and seeing them through to implementation.

This is an exciting time for us, as our team now includes an array of new colleagues who offer advisory and technical skills that are complementary to our own including Climate Resilience & Net Zero, Natural Capital & Biodiversity, Social & Community Impact, and Responsible Sourcing.

We would like to take this opportunity to invite you to check out the SLR website, so you can see the full potential of what we are now able to offer.

This article takes the form of a Q&A session through which some of the most frequently raised questions about S&P Global’s Corporate Sustainability Assessment and the associated Dow Jones Sustainability Indices (DJSI) will be answered. In addition, answers to the questions retrieved from the Leveraging your CSA participation webinar, held on 27 September, 2022, will also be provided.

Q: What is the Corporate Sustainability Assessment (CSA)?

A: Owned and managed by S&P Global, the CSA is an annual assessment of companies’ sustainability performance. Companies that are invited to participate in the assessment are asked to fill out an industry-specific questionnaire reflecting on ± 20-30 of the most material ESG issues tailored for 61 different industries, such as Banks, Chemicals, or Telecommunication Services.

Companies can provide two types of input to demonstrate their ESG performance: information that is available in the public domain, and internal information, which is treated on a confidential basis by S&P Global. If companies choose not to actively participate in the assessment, they will still be scored by an S&P Global analyst based exclusively on publicly available information, such as the company’s annual report and corporate website.

As a result of this assessment, an overall ESG score between 0-100 points is attributed to the company. ESG scores are made available to the global investment community through S&P Global’s data platforms and are accessible to the global public via S&P Global’s ESG Scores webpage.

Q: What are the benefits of participating in the CSA?

A: There are several benefits to be derived by companies from participating in the CSA. One of them is to become included in the Dow Jones Sustainability Indices (DJSI), provided that your company’s ESG score is high enough to rank among the leaders of your industry. Even if the company is not admitted into the DJSI, the ESG data is of relevance to investors. Representing over US $26 trillion in Assets under Management and with over US $13 trillion in assets owned, S&P Global clients now integrate S&P Global scores into their investment decision-making processes and sustainable products and services. In addition, the CSA will enable your organization to establish a baseline for your sustainability performance and learn from best practice examples to build a stronger ESG approach while staying on top of changes.

Other benefits include reducing your reporting burden due to the CSA alignment with leading sustainability frameworks (e.g., GRI, CDP, GRESB), increasing internal awareness of sustainability by engaging your teams in the questionnaire completion process, and being included in the S&P Global annual Sustainability Yearbook.

Q: Can the CSA be used to enhance corporate ESG reporting?

A: Although S&P Global strives to align the ESG data requests with different corporate sustainability reporting standards such as GRI, CDP, and GRESB, it is yet to reach a point of full consolidation.

A general recommendation for how the CSA can help to enhance your corporate ESG reporting is to first start with identifying and defining your material issues. Then, a next step is mapping your company’s material issues against sustainability reporting and rating requirements (GRI, CSRD, CSA, CDP), including metrics, qualitative disclosures, and policies. This will enable you to identify requirement overlaps and pick your priorities for enhancing ESG reporting.

Q: What other stakeholder groups next to investors are interested in the CSA?

A: S&P Global spans the interests of not only investors but also peer companies and the wider civil society by aligning its assessment requirements with reporting standards such as GRI and SASB, certification standards such as ISO and EMAS, and legal frameworks and regulatory measures such as those developed by the European Commission (e.g., EU Taxonomy). Alignment and collaboration with TCFD, CDP, B4SI and nonprofit organizations such as the Ellen MacArthur Foundation is also in place.

Q: How does the CSA take the rapid changes in society and business into consideration?

A: Every year, S&P Global applies methodology changes to continue to be able to identify the world's leading companies in ESG. These changes are motivated by evolving trends and emerging material issues, company engagement, alignment with thought leaders, and developments in sustainability reporting standards. The investor audience which makes use of companies’ ESG scores also provides input for which elements they would like to see assessed in the CSA.

Q: Can your score sufficiently reflect your company’s ESG performance if you are not actively participating in the CSA and relying only on S&P Global’s assessment of your company’s publicly available information?

A: Public information is not the only ingredient of the CSA. In fact, although S&P Global continuously expects companies to make information publicly available, part of the assessment still requests companies to provide information that is not necessarily disclosed in the public domain. Questions that do not require public evidence are also scored and thus, they can contribute to increasing or decreasing overall companies’ scores in the same way as questions that ask for publicly available information. Therefore, it’s typical to see that companies that opt not to participate have lower ESG scores than those that do.

Q: What is the timeline for the whole CSA process?

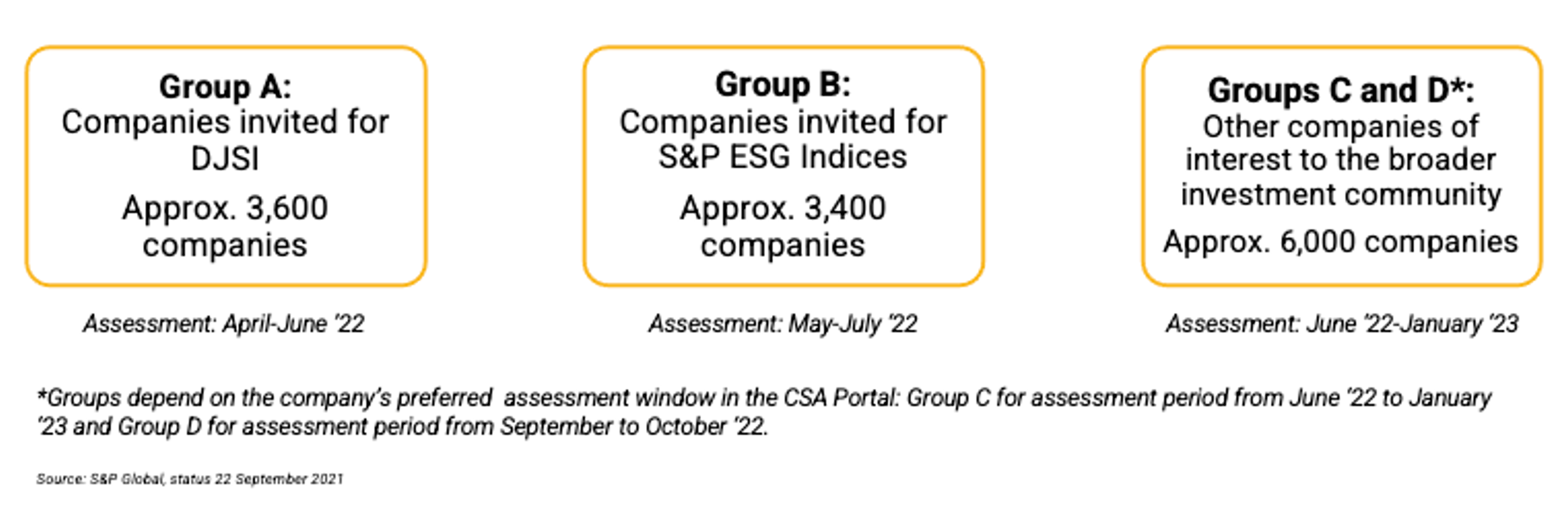

A: Every year, S&P Global establishes a timeline for the CSA for different groups. Based on the company’s market capitalization, it can be categorized in one of the following groups:

This year, a timeline has been established, starting with companies eligible for inclusion in the Dow Jones Sustainability Indices (Group A) or for the S&P ESG Indices (Group B). For these companies, although the timeline was slightly different, all participants had already submitted their answers before the end of the summer and they are receiving their scores in the coming months. For Group A, while a first wave of results was released on 23 September 2022, the second wave will be released on 21 October 2022 and the announcement of DJSI members will take place on 9 December 2022. For Group B, announcement of ESG scores is expected between November and December 2022, depending on submission date.

Regardless of their eligibility for ESG indices this year, other companies have been invited to complete the assessment as their sustainability performance is of interest to the broader investment community. For most of those companies (Group C) whose deadline for submitting their answers is January 12, 2023, the questionnaire has been open since June 2, 2022, and their scores will be released during the first quarter of 2023.

Q: How can companies find out if they are eligible to participate in the CSA?

A: Companies invited to participate in the CSA receive an invitation email sent by S&P Global. If no such email has been received, it is also possible to check whether your company is invited via the invitation list published on the S&P Global website.

Q: Are scores accessible via the CSA platform for companies that do not participate in the assessment?

A: As a non-participating company, you will only be assessed based on publicly available information, but you can request access to the CSA portal, just like participants. However, you will only be able to see overall scores and criterion scores, not the scores at question-level.

Q: Are the DJSI and the CSA as relevant for European companies as American ones?

A: The Dow Jones Sustainability Indices are a family of indices containing one main global index, the DJSI World, and various indexes based on geographic regions such as Europe, North America, Asia Pacific, and Emerging Markets. In this way, it is as relevant for European companies as American ones to take part in the CSA which can enable them to be included in one or several of these indices. As for the CSA, it is a global assessment that is not more relevant or adapted to American companies. Companies that are facing challenges in certain areas of the assessment due to local legislation, can explain this in their answers.

Q: How can companies optimize their participation in the CSA?

A: The main tips to prepare for and be successful in your participation in the CSA are to start with your own sustainability program as a point of reference, to define the ‘quick wins’ while planning to address longer-term structural changes, and to ensure a strong engagement with internal topic experts who contribute to the questionnaire, such as your Human Resources and Legal departments. If you are interested in more tips, this article is a a further helpful resource.

With over 15 years of experience in ESG Benchmarking support including the CSA and CDP, Finch & Beak is one of Europe’s leading experts in improving our clients’ sustainability programs and ESG performance, including support on double materiality, sustainability governance, and TCFD implementation.

If your organization is looking to accelerate its sustainability performance, please contact Johana Schlotter, at johana@finchandbeak.com or call +31 6 28 02 18 80.

Photo by Lars Kienle on Unsplash

Enthusiastic professional aiming to support companies in improving their commitment to sustainability. | marie@finchandbeak.com

Finch & Beak

hello@finchandbeak.com

+34 627 788 170